Basic Knowledge for Bullion Trading

Gold/Silver Trading: Basic Investment Knowledge

What is bullion?

The global financial market has experienced frequent fluctuations in recent years, and Bullion has become one of the popular investment products. Rakuten Securities Bullion HK provides gold and silver trading with zero transaction fees and a low entry threshold. Investors do not need to buy or hold physical gold and silver. They can use the strategy of buying low and selling high anytime and anywhere through an efficient and stable Fintech trading platform.

Factors that affect precious metals price

Interest rates

Gold prices are sensitive to interest rate movements. Under normal circumstances, there is a negative relationship (=correlation) between gold and interest rates.

Worldwide demand and supply

Growing demand and constrained supply can push precious metals prices higher.

US dollar movement

Since the prices of international gold/silver are denominated in dollars, any weakness in the dollar will increase the demand for gold and push up the prices and vice versa.

Geopolitical factors

When geopolitical events arise, the gold price usually goes up. When crises occur, the prices of most assets will have a negative impact but there is a positive impact towards gold as it acts as a safe-haven investment.

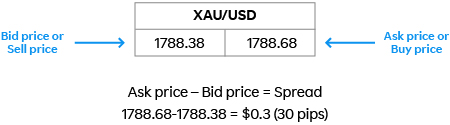

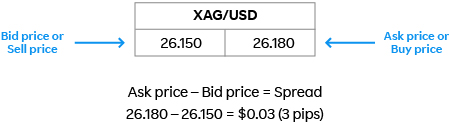

Bid/Ask spread

The spread refers to the difference in the bid and ask prices, which can also be considered as the cost in bullion trading.

Gold trading spread

Silver trading spread

Initial margin

In order to open a new position, available account equity must exceed the initial margin level requirement.

The initial margin level requirement is 0.5% (leverage ratio 200:1) of open positions value.

Initial margin for gold

0.1 lot x 100oz x US$1788.00 x 0.5% = US$ 89.4

1 lot x 100oz x US$1788.00 x 0.5% = US$ 894.0

10 lot x 100oz x US$1788.00 x 0.5% = US$ 8,940.0

Initial margin for silver

0.1 lot x 5000oz x US$26.20 x 0.5% = US$ 65.5

1 lot x 5000oz x US$26.20 x 0.5% = US$ 655.0

10 lot x 5000oz x US$26.20 x 0.5% = US$ 6,550.0

Profit / Loss calculation on gold and silver trading

Profit / Loss calculation on gold trading

P/L calculation formula: Lots × Contract size(oz) × (Close price – Open price) = P/L (USD)

*Lots: +ve for buy order, -ve for sell order

*Contract size for Gold is 100oz per lot

Profit / Loss calculation on silver trading

P/L calculation formula: Lots × Contract size(oz) × (Close price – Open price)= P/L (USD)

*Lots : +ve for buy order , -ve for sell order

*Contract size for Silver is 5,000oz per lot

Introduction on gold & silver trading methods

Investment method | Commission/ Fee | Trading direction | Trading method |

Gold / Silver ETF | Higher (plus management fees, preservation fees, etc) | One-way trading | Stock exchange, banks non-24 trading hours, high fund threshold |

Gold / Silver futures/option | Higher (Normally a percentage of the transaction amount, as stipulated by the exchange.) | Two-way trading | Futures exchange, non-on 24 trading hours, high fund threshold |

√ CFD (Contract for Difference) | √ Zero | √ Two-way trading | √ CFD Trading Platform 24 trading hours, low fund threshold |

Physical Gold /Silver | Floating / higher | One-way trading | Banks, jewellery shop, physical settlement |

Gold / Silver passbook | Higher | One-way trading | Bank |

Trading hours during public holidays

Trading hours may be altered according to the CME (the Chicago Mercantile Exchange Inc) Globex trading schedule. Please visit the link below for details.

FAQs for Investing in Gold

What are the benefits of investing in gold?

As a globally recognised asset, gold is easily convertible into cash and currency, and is widely regarded as a safe haven against inflation, active instability and the risks associated with financial crises. Apart from the fact that gold has a high ability to retain value over the long term, which is conducive to long-term investment and maintaining asset value, the gold market is also highly liquid and is not subject to trading hours, making it easy to trade in and out of the market. Moreover, since the price fluctuation of gold is generally not related to the stock and bond markets, the inclusion of gold in the investment portfolio can achieve diversification and reduce investment risks.

What are the risks of investing in gold?

There are always risks involved in any investment, and the same applies to gold investment. The price of gold may also fluctuate due to global instability, political events, changes in supply and demand, and inflationary uncertainties, which may affect investment returns and even losses. In addition, different countries and regions have different legal and tax regulations on gold investment and trading, which may also have an adverse impact on investors.

Is gold worth investing?

Including gold in the investment portfolios can help to diversify investment risk, but you should consider whether it meets your investment objectives and risk tolerance.

FAQs for investing in Silver

What are the benefits of investing in silver?

Silver, like gold, is a valuable and tangible asset that can act as a hedge against inflation and economic instability. It is highly versatile, with uses in various industries, including electronics, solar energy, and medical devices, which can drive demand and support its value. Silver’s lower price point than gold also makes it more accessible for smaller investors. The silver market is also highly liquid, allowing investors to easily buy and sell.

What are the risks of investing in silver?

Investing in silver comes with its own set of risks. The price of silver can be highly volatile due to its dual role as both an industrial metal and a precious metal. Market fluctuations, changes in industrial demand, and global economic conditions can significantly impact silver prices. Moreover, legal and tax regulations related to silver investment vary by country and can affect overall returns.

Is silver worth investing in?

Including silver in your investment portfolio can help diversify risk, especially given its distinct price movement compared to stocks and bonds. However, it is crucial to assess whether silver aligns with your investment goals and risk tolerance.

To understand the advantages and disadvantages of gold and silver investment, we suggest joining our Seminar/ Webinar and having private 1-on-1 Training with our customer service representative.

If you have any questions/ enquiries about investing in gold and silver, feel free to contact our customer service representative.